Introduction

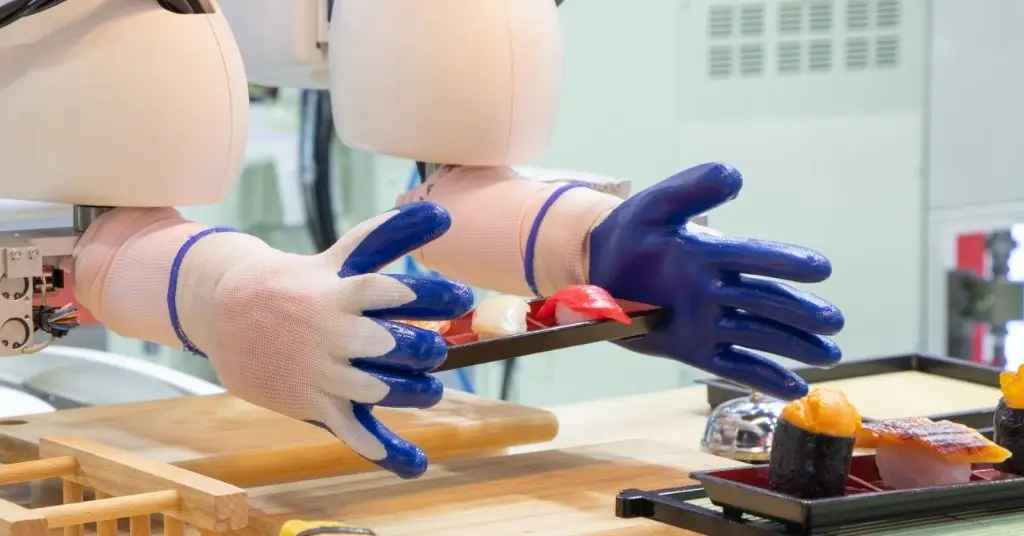

In the past few days, a wave of announcements from major U.S. restaurant chains has made one thing clear: artificial intelligence is no longer a futuristic promise, it’s already entering the order-taking pipeline. From phone calls to drive-thrus to chatbot upsells, AI is rapidly moving from pilot mode toward mainstream deployment. This shift has serious implications for labor, customer experience, and margins in an industry already under pressure.

Why AI Order Assistants Are Trending Now

Immediate cost and staffing pressures: In 2025, restaurants face surging food prices, wage inflation, and ongoing labor shortages.

Technology maturity: Voice AI, natural language processing, and cloud/edge infrastructure are now robust enough to handle real customer interactions with fewer errors.

Competitive signaling: When big chains like Red Lobster commit to AI order assistants, it pressures others to adopt or risk being seen as behind the curve.

Consumer expectations: Customers increasingly expect quick, seamless ordering, whether via apps, kiosks, or voice across all service types.

Recent Moves: Who’s Leading the AI Order Shift

Red Lobster

Red Lobster has publicly announced that all 545 locations will integrate a voice-AI order assistant for takeout calls. The system is powered by SoundHound’s voice AI, enabling the chain to answer all phone orders with reduced wait times and agent burden.

This is a strong statement: it moves AI ordering from the laboratory to live operation across a large chain.

Wendy’s

Wendy’s is scaling its AI order assistant expansion—known as FreshAI—with plans to deploy in 500–600 drive-thrus by the end of 2025. The chain’s earlier pilots have shown promise in accuracy and speed.

Applebee’s / IHOP (Dine Brands)

Dine Brands (parent of Applebee’s and IHOP) has been developing an AI personalization engine using customer data to suggest menu items, discounts, and ordering experiences. They also hint at tools like AI-powered cameras to detect table cleaning needs or staffing alerts.

These developments show that AI is not just being used for order capture, but also for upsell, operational insight, and customer interaction.

What These AI Systems Mean for U.S. Restaurants

1. Labor redistribution, not replacement (yet)

While there’s concern that automation could displace workers, in the near term these systems are more likely to relieve staff of repetitive tasks—like taking routine orders—allowing them to focus on upselling, hospitality, or complex issues.

Still, operators must plan for potential shifts in staffing roles and job retraining.

2. Margin relief in slim environments

Order-taking labor is not cheap. If AI can reduce staff time spent on calls, handle surges, and reduce no-response losses, that can help margins. That matters in 2025, when food-away-from-home prices are projected to rise ~3.9%.

3. Quality and accuracy are make-or-break

Early AI systems struggled with accents, background noise, or menu complexity. A poor experience can hurt brand loyalty. Chains must invest heavily in training, fallback routing to humans, and continuous improvement.

As one industry report noted, restaurants must balance “experience and efficiency” in their tech adoption.

4. Data & personalization boost

These AI systems aren’t just order takers—they collect data on ordering patterns, preferences, and conversion behavior. Proper use can enable personalized menus, dynamic pricing, and targeted offers.

The trend of “superhuman hospitality” emphasizes combining automation with emotional, empathetic touch.

5. Competition and differentiation

If everyone adopts AI ordering, it becomes a baseline. The next frontier will be which AI performs best, integrates with your brand, and elevates loyalty. Chains that differentiate will gain advantage.

Challenges Restaurants Must Navigate

| Challenge | Risk / Consideration | Mitigation Strategy |

|---|---|---|

| Order errors & misunderstandings | Customer frustration, brand damage | Use fallback to human agent, continuous retraining, multi-modal input (text fallback) |

| Initial investment & integration | Hardware, software, labor to deploy | Phased rollout, vendor partnerships, pilot with key locations |

| Customer resistance | Some prefer human interaction | Always offer “speak to human” fallback, allow opt-out |

| Data privacy & security | Handling PII, voice data, compliance | Strong encryption, clear privacy policies, minimal retention |

| Operational complexity | Syncing AI orders with POS, kitchen timing | Use robust middleware, integration, buffer logic |

What Restaurant Owners in USA Should Do Now

Pilot in low-risk channels

Start with phone takeout or select drive-thrus before full rollout.Select strong AI vendors

Look for voice models with domain adaptation, error recovery, and solid integration with your POS and backend systems.Train your team for new roles

Staff may shift to oversight, customer recovery, or upselling roles. Upskill early.Monitor metrics diligently

Track order accuracy, “human takeover” rates, customer satisfaction, and return on investment.Maintain human touch options

Always allow customers to bypass AI and speak to a human. Hybrid service smooths the transition.Leverage data insights responsibly

Use anonymized data to personalize offers, not to overreach or alienate customers.

Conclusion

AI order assistants are no longer speculative—they’re being launched in hundreds of U.S. restaurants this week. For operators, this is a pivotal moment: adopt early and smart, or risk falling behind. Success depends not only on technology but on seamless experience, staff adaptation, and data strategy.