The U.S. restaurant industry is navigating a complex landscape in 2025. According to the bank’s recent “State of the Restaurant Industry 2025” report, operators face a mix of spending strength, shifting consumer behaviour and cost pressures. This article breaks down the essential findings and what they mean for restaurant owners across the United States.

1. Spending is holding up – but traffic and value perceptions are shifting

On the positive side, restaurant spending continues to climb. Bank of America internal data show that spending at full-service and casual dining restaurants has increased, and notably, restaurant-away-from-home spending has surpassed grocery spending in recent months.

However, there are important qualifiers:

Consumers are becoming more selective, especially households with lower income or in economically stressed regions. The report notes that while spending may rise, frequency of dining out is falling for some segments.

Notably, consumers are re-evaluating the value proposition of limited-service restaurants (QSRs). The gap between price and perceived value has narrowed. As noted: “Prices at QSRs have come up to the point where casual dining is now viewed as a value.”

While nominal sales may be up, one key metric—traffic (the number of visits)—is showing signs of softness in certain segments.

Implications for restaurant owners:

You may be seeing higher average checks (thanks to inflation and price increases) but fewer guests, or more guests choosing fewer items. You’ll need to focus on value, quality, service culture and experience if you want to maintain or grow traffic rather than relying solely on price increases.

2. Cost pressures and workforce challenges remain acute

The report emphasizes that rising food and labour costs continue to squeeze margins. Even as inflation has shown signs of moderating, for many restaurants the “input cost shock” remains significant.

On workforce:

Employee turnover remains high and recruiting remains a challenge. The report underlines that “restaurants are a people business; your assets walk out the door every day…”

One dated study from the bank’s materials shows that despite some easing, labour pressures remain a key line item for operators.

What this means practically:

You’ll want to double-down on staff culture, training and retention strategies, but also examine how technology and operational design (menu simplification, automation, streamlined service) can help offset cost and labour pressures. Maintaining or improving guest experience while managing costs is a tightrope.

3. Format and segment shifts are underway: QSR vs Casual Dining

A key insight: limited-service (fast food/quick service) restaurants (LSRs/QSRs) are seeing faster transaction growth than full-service restaurants (FSRs), though value and consumer choice are shifting.

Further, the report indicates that casual dining and full-service restaurants have seen growth in visits in some markets, partly because consumers perceive them as better “value” when the price differential narrows.

Take-away for owners and operators:

If you’re in the QSR/fast-casual space: simply relying on volume may not be enough; you’ll need strong value messaging, efficient operations and differentiation.

If you’re in the full-service/casual dining space: you may have an opportunity to capture guests who are trading “down” from premium or “up” from QSRs — but you must deliver on quality, experience and perceived value.

Monitor your segment’s traffic trends carefully. Where traffic is lagging, you may need to refresh your menu, guest experience or promotional strategy.

4. Strategic Outlook: consolidation, technology and value are front-and-centre

The report points to a few forward-looking themes that restaurant owners should keep on their radar:

M&A activity and brand consolidation: For 2024–2025 the bank anticipates increased mergers and acquisitions in the sector as operators and investors look to scale, optimize and exit.

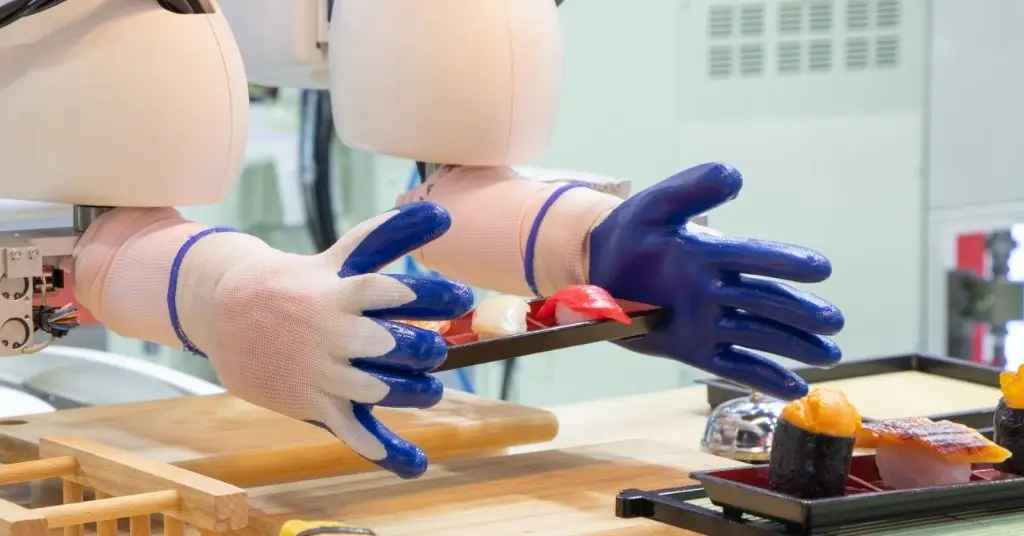

Technology and innovation as differentiators: The bank’s research emphasises that “culture, innovation and a focus on promotion can be powerful differentiators.” Automation, mobile ordering, digital engagement and operational tech continue to be key.

Value & menu engineering: Given cost constraints and consumer selectivity, menu strategy, limited-time offers (LTOs), value promotions and efficient back-of-house become ever more important.

Action steps:

Review your strategic plan: Are you evaluating partnerships, brand expansion or consolidation opportunities?

Audit your technology stack: Is your ordering/fulfilment system optimized? Are you leveraging data to improve guest loyalty and personalization?

Menu revisit: Are you hitting the right balance of value, margin and guest appeal? Are you tracking traffic dips and guest feedback?

5. Key numbers worth noting

Spending growth on restaurants recently has outpaced grocery spending, according to aggregated card data.

The number of transactions in limited-service restaurants has grown faster than full-service since Fall 2023.

Economic confidence and income growth are uneven: higher-income households show stronger spending momentum; lower-income segments are more constrained.

6. Final thoughts: How U.S. restaurant owners should interpret these insights

The 2025 report from Bank of America paints a cautiously optimistic picture: yes, there is resilience in consumer dining-out behaviour, but it is increasingly selective, value-focused and shaped by cost pressures. Restaurant success in this environment will depend on execution — delivering value, strong experience, operational efficiency and staying agile.

For U.S. restaurateurs, the imperative is clear:

Focus on maintaining traffic and check size, not just pricing.

Invest in the guest experience (service culture, staff training) because consumers are comparing value more consciously.

Embrace technology and operational innovation to control costs, enhance convenience and personalize experience.

Keep an eye on macro-data (spending trends, consumer confidence, income gaps) as early indicators of shifts in behavior.

Don’t assume past growth patterns will persist — the market is evolving. Eating-out is still popular, but how, when, where and what consumers choose is changing.

By treating this moment as one of strategic re-calibration rather than business-as-usual, restaurant leaders can position their brands not just to weather uncertainty but to thrive.